The 5 most popular cocktails in Poland and the difference between north, south and Warsaw

A brand new category has recently been added to SharpGrid's BI tool Market Meter - Mixed drinks. Our clients can now measure and understand a wide range of cocktails and drinks in the on-trade channel with insights about the numeric distribution and pricing development over time across regions and outlet segments. And they can also make decisions on how to best benefit from these market trends and position their brands for success. Using Market Meter, we set our sights on mixed drinks in Poland to test the new category in action.

How to define the most popular cocktails?

As a starting point for our research, we divided Poland into 3 areas and tested them against the national average:

- The North (sea areas)

- The South (mountain areas)

- Warsaw

Why like this? We wanted to see if we can spot similarities or find major differences between the tourist-heavy north and south. As for Warsaw, the capital cities often differ from the rest of the country in the type of consumption or on-trade market composition so we were curious if that applies to mixed drinks as well.

Our core metric is numeric distribution, which is a percentage of on-trade outlets or points of sale serving this cocktail within the whole market universe (if there were 2 bars in Poland and 1 of them served Mojito, its numeric distribution would be 50%). To put it plainly, the higher the numeric distribution, the more places serve this drink. With a bit of exaggeration we can say that the numeric distribution reflects the drinks’ popularity in general.

Most popular cocktails in The North: Margarita reigns supreme

In the coastal north of Poland we count three voivodeships: Pomorskie, Zachodniopomorskie and Warmińsko-Mazurskie. The whole area is characterized by a maritime climate, but also by a belt of lakes stretching from west to east, making it an ideal tourist destination with two main hubs Gdańsk and Gdynia (both in Pomorskie voivodeship).

The overall winner of The North is Margarita, a tequila-based cocktail served usually with an orange liqueur, lime juice and a bit of salt on the rim of the glass, which gives the drink its typical bite. The top 3 drinks for each voivodeship are as follows:

Pomorskie

- Margarita 52.93%

- Mojito 38.75%

- Aperol Spritz 39.29%

Zachodniopomorskie

- Margarita 50.58%

- Mojito 48.78%

- Cuba Libre 43.99%

Warmiňsko-Mazurskie

- Cuba Libre 55.46%

- Mojito 50.86%

- Margarita 49.07%

Margarita is especially strong in Pomorskie voivodeship, home of the two major cities Gdańsk and Gdynia (the third major northern city Szczecin is a bit further inland, separated from the sea by the Szczecin lagoon) teeming with life, cultural events and hosting a lot of students and beach-craving tourists. You can see that the difference is really striking compared to the other two voivodeships.

Our guess? Margarita is a social cocktail that calls for a larger group of people, an interesting social event, gathering or a party. And where else to experience something like this in northern Poland than in Gdansk and Gdynia?

Best cocktails of The South: It's Margarita again

For our purposes we have defined the mountainous southern parts of Poland by four voivodships: Śląskie, Dolnośląskie, Podkarpackie and Małopolskie.

Śląskie voivodeship is beloved for its Silesian Beskids mountain range, the source of Poland’s biggest river Wisła. Dolnośląskie consists of the Karkonosze Mountains with the famous Szklarka Waterfall or Chojnik Castle ruins on a towering rock near the Jelenia Góra city, but also of Stołowe mountains full of massive plateaus of fantasy-stirring shapes.

In the Podkarpackie and Małopolskie voivodships you can find a whole host of mountain ranges, namely:

- The magnificent Tatras on the Slovakian border with a wide network of hiking trails.

- The Pieniny Mountains with the Dunajec River gorge and 14th century Niedzica Castle.

- The Gorce Mountains with an observation tower at the summit of Mount Magurki.

- The Żywiec Beskids mountain range full of picturesque villages dotting the forested valleys and Sopotnia Wielka waterfall.

- The Bieszczady Mountains are considered the “wildest” Polish region with serene beech forests far from civilization.

All in all, the south of Poland is known mostly for hiking, winter sports and secluded nature retreats in the vast, sparsely populated landscapes. But what kind of cocktail do all these hikers, skiers and tranquility-loving tourists drink?

Well, it’s Margarita again, but with a much smaller margin than in the north. Generally speaking, while the top drink in the north always had over 50% numeric distribution, in the south the winner’s dominance was much smaller, indicating a more diverse cocktail scene there.

The difference becomes even more obvious by comparing the average numeric distribution of Margarita in the two areas:

- The North: 50.86%

- The South: 38.67%

And here are the top 3 results for each voivodeship:

Śląskie

- Margarita 32.58%

- Cuba Libre 30.67%

- Mojito 34.44%

Dolnośląskie

- Aperol 45.43%

- Mojito 41.95%

- Margarita 39.71%

Podkarpackie

- Margarita 39.31%

- Mojito 35.37%

- Cuba Libre 23.21%

Małopolskie

- Margarita 43.08%

- Mojito 41.89%

- Aperol 36.86%

If you compare these numbers with the ones from The North, you can see the market is much less concentrated in The South. The average numeric distribution for a mixed drink is 8.1% in Pomorskie voivodeship, 9.9% in Warmiňsko-Mazurskie voivodeship (both northern), but only 5.4% in Śląskie voivodeship - about half of Warmiňsko-Mazurskie.

This means you’d need to have a really strong product portfolio, flawless strategy and generally put in a lot more effort to penetrate the northern cocktail scene in a meaningful way than in the more heterogeneous southern voivodeships’ markets.

Dolnośląskie: The Lone Tequila Empire

Our data revealed one small peculiarity. In the Dolnośląskie voivodeship, Tequila Sunrise got 31% numeric distribution (twice as much as in the Mazowieckie, Małopolskie, Śląskie, Wielkopolskie, Podkarpackie and Podlaskie voivodships) while the average for Poland as a whole is only 19.9%. Margarita is also quite strong there (despite not being the winner), so we guess some hardcore blue agave liquor lovers live in the Dolnośląskie voivodeship.

The Warsaw Cocktail Choice

It starts to look like the Margarita is Poland’s go-to drink, right? The race in Warsaw (Mazowieckie voivodeship) was tight but Margarita won again, by a margin of 0.37%. No surprises here as the second and third place went to cocktails popular elsewhere too:

Mazowieckie

- Margarita 31.56%

- Mojito 31.19%

- Aperol 27.69%

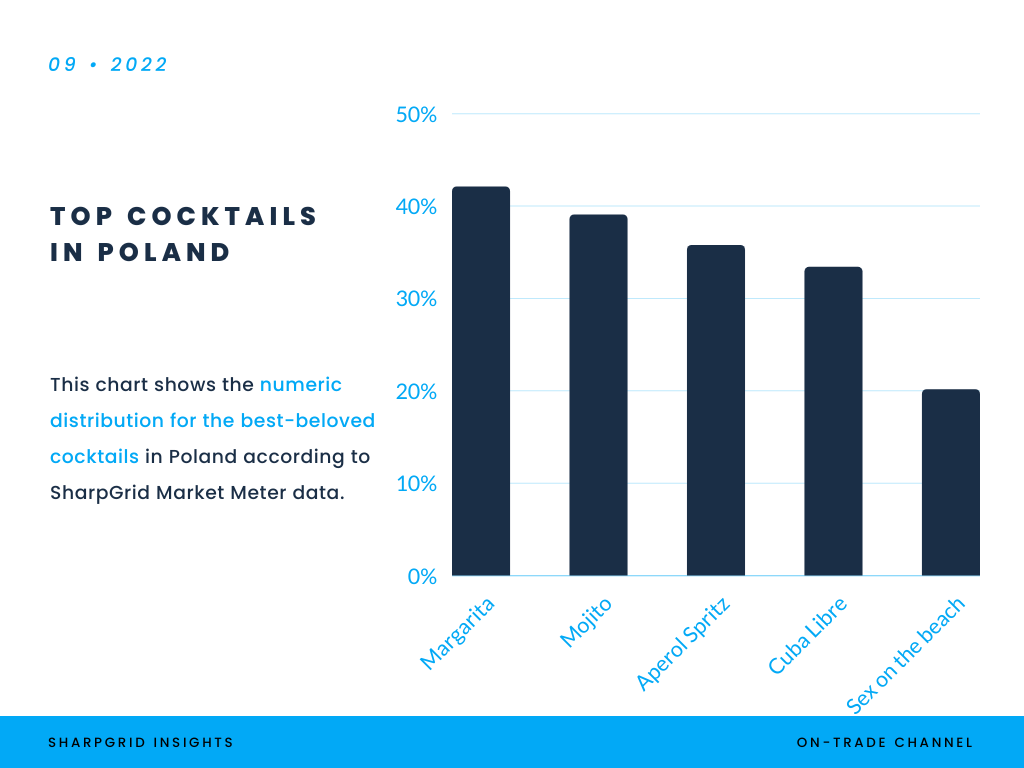

All of Poland: The most popular cocktail is no surprise

You’ve probably guessed by now that the most popular cocktail in Poland is… Margarita. If you’re wondering how our 3 ad-hoc regions compare to the Poland average, here is a table of the top 5 cocktails in Poland according to their numeric distribution:

And here is the number of on-trade outlets like bars, pubs or clubs where you can find tem:

- Margarita: 11 735 outlets

- Mojito: 10 894 outlets

- Aperol Spritz: 9969 outlets

- Cuba Libre: 9308 outlets

- Sex on the beach: 5610

Looking at these and previous numbers, we can say that The North is really big on Margarita (51% vs 42% national average), The South is almost in line with the national average and Warsaw’s Margarita numeric distribution is way below average (32% vs 42%). Quite a huge difference!

Also see the big gap between 4th and 5th place? Poland seems to be dominated by a strong quartet of Margarita, Mojito, Aperol Spritz and Cuba Libre cocktails. For comparison: Margarita has only 11.5% numeric distribution in Czechia.

Chasing the cocktail trends

To conclude this analysis, we also looked at the evolution of the numerical distribution of these cocktails over time and compared the percentage with the previous quarter (Q1 2022 vs Q2 2022) to find out which cocktails are on the rise and which ones are losing popularity.

Top 5 cocktail gainers:

- Piňa Colada + 2.6%

- Margarita + 1.12%

- Paradise + 0.82%

- B52 + 0.81%

- Hugo Spirits + 0.65%

Top 5 cocktail losers:

- Pink Lady - 4.56%

- Sex on the beach - 3.46%

- Cosmopolitan - 2.69%

- Cuba Libre - 2.66%

- Long Island Ice Tea - 2.47%

As you can see, 2 of the 5 best cocktails are currently losing numeric distribution (Cuba Libre with -2.66% and Sex on the beach with -3.45%) and the longer list - not included in this article because of its length - actually features another 2 of the 5 best cocktails: Mojito (-1.72%) and Aperol Spritz (-1.18%).

This brings the total count of the best cocktails on the "losers" list to 4 out of 5. If this trend continues and their numeric distribution keeps diminishing, maybe the top 5 list will look completely different in a few quarters.

Currently, only Margarita is standing strong with a positive uptick in numeric distribution. It is actually the second best performer of the second quarter after Piňa Colada.

READ MORE: THE 3 "PARTY CAPITALS" OF CENTRAL EUROPE

The Lesson: Don’t trust averages

If there's one lesson you should take away from this article, it's that averages might be misleading and regional differences can make a huge difference, so it's worth approaching the market selectively and focusing on pinpointed locations based on what type of drink has been popular in the area for a long time.

FREE MARKET REPORT: BROWSE UP-TO-DATE NUMERIC DISTRIBUTION DATA FREE OF CHARGE

At SharpGrid we have access to all this data and you can too. Contact us and ask for details, learn more about selective outlet targeting from one of our clients’ success stories, try our Free Market Report or get inspired by more articles like this on our On-trade Insights blog.

And don’t forget to grab a Margarita afterwards. Cheers!

—

Postscript: Outlet base used in this study

The core outlet base for this study consists of 27 900 bars, pubs, restaurants and other places in Poland that offer at least one mixed drink. So the top 5 cocktails’ numeric distribution in Poland refers to this number (e. g. a drink with 50% numeric distribution would be served at 13 950 places).

For regional percentage results we were working with a local outlet base for each region (e. g. a cocktail with 50% numeric distribution in the Śląskie voivodeship would be served at half of all outlets offering at least one mixed drink in said voivodeship).

If you visit our Free Market Report page, the numbers will be slightly different (even though they are too based on Market Meter) as its outlet base is more basic, consisting of places offering at least one hard liquor brand or drink instead of at least one mixed drink, making it quite wider and therefore the percentage smaller. To access truly granular data like detailed distribution, pricing and other high-tier insights, you would need a full version of the Market Meter.

SharpGrid is a data & tech company reinventing market research in the on-trade channel. The on-trade channel consists of POSs (points of sale) like restaurants or bars where food & beverage is bought and consumed, and is often also called HoReCa, on-premise, food service, out-of-home, gastro or immediate consumption (IC) channel, hospitality or on-licence.